End-to-End Algo Software Development Lifecycle

End-to-End Algo Software Development Lifecycle

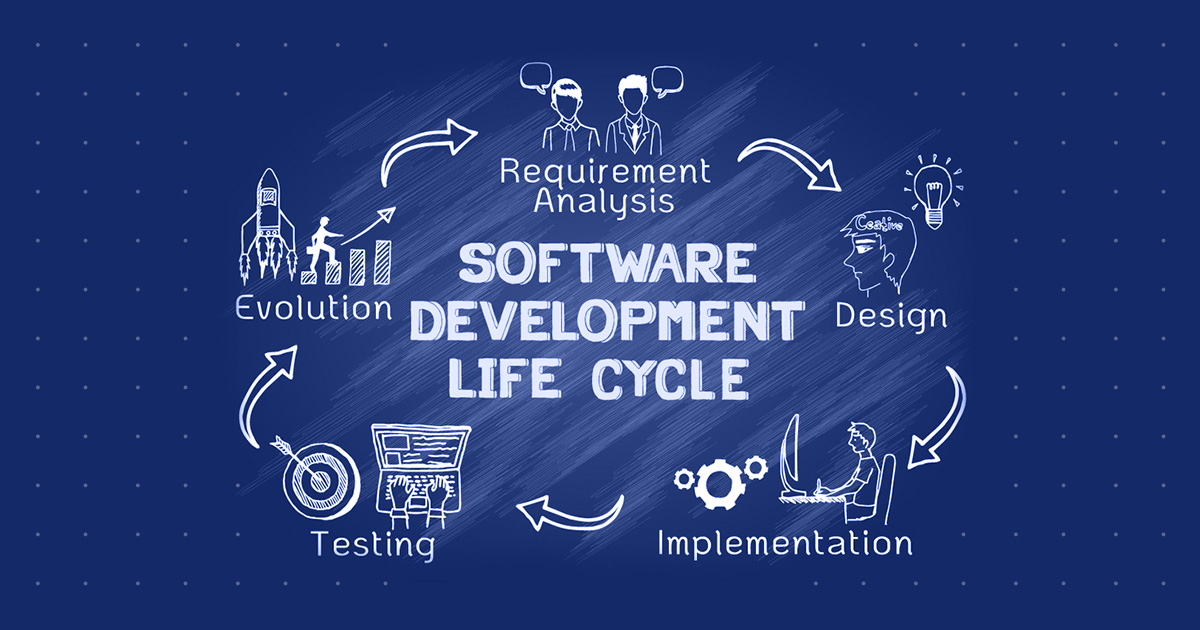

Professional algo software development requires a structured, performance-focused lifecycle. Our approach ensures reliability, scalability, and profitability at every stage.

Development process includes:

Strategy research & quantitative modeling

Data engineering & market data normalization

Algorithm design & optimization

Backtesting using historical datasets

Paper trading & simulation

Live deployment & monitoring

This disciplined approach enables us to deliver stable Algo Trading Software Development solutions trusted across global markets.

Backtesting & Optimization for Reliable Algo Trading

Backtesting is critical to the success of algorithm based stock trading. Our platforms provide advanced simulation tools to test strategies under different market conditions.

Key capabilities:

Tick-level historical data analysis

Slippage & transaction cost modeling

Walk-forward optimization

Stress testing during volatile markets

These tools help traders refine Algo Trading Strategies before deploying real capital.

Risk Management in Algorithmic Trading

Effective risk management is embedded into every Trade Algo Software we build. Automated risk controls protect capital and ensure long-term sustainability.

Risk management features include:

Position sizing algorithms

Stop-loss & trailing-stop automation

Drawdown limits

Exposure & margin monitoring

These mechanisms make our platforms suitable for institutions seeking the Best Algorithmic Trading Software.

Best Advanced Trading Platform with Real-Time Analytics

Our solution operates as a best advanced trading platform, providing real-time insights through intelligent dashboards.

Advanced analytics include:

Performance metrics & KPIs

Strategy-wise profitability tracking

Risk-adjusted return analysis

Live market heatmaps

These advanced trading tools enable traders to make data-driven decisions instantly.

Multi-Broker & API Integration Capabilities

Our Algo Trading Platform seamlessly integrates with global brokers, liquidity providers, and exchanges.

Supported integrations:

Indian brokers for Algo Trading in India

US & global brokers for Algo Trading in US

European broker APIs for Algo Trading Services in UK and Germany

Forex & crypto liquidity providers

This flexibility ensures uninterrupted execution across markets.

Cloud-Based Infrastructure for Scalable Algo Trading

We use modern cloud architectures to ensure high availability and scalability.

Infrastructure benefits:

Low-latency execution

Auto-scaling for high market activity

Secure data storage & encryption

24/7 system monitoring

This infrastructure supports high-performance Forex Algorithmic Trading and equity automation globally.

Algo Trading Marketplace & Strategy Distribution

Strategy distribution is a growing trend in automated trading. Our systems support integration with Algo Trading Marketplace platforms, including Tradetron Algo Strategy Marketplace.

Benefits include:

Strategy monetization

Subscription-based algo access

Rapid deployment for users

Scalable performance across accounts

This empowers both traders and strategy creators.

Algo Software for Professional & Retail Traders

Our algo software is designed to serve:

Institutional trading desks

Hedge funds & prop firms

Professional retail traders

Strategy developers

With flexible configuration and enterprise-grade performance, it adapts to all experience levels.

Compliance & Security in Algo Trading Platforms

Security and compliance are essential in financial systems. Our Algo Trading Software Development follows industry best practices.

Security measures include:

End-to-end encryption

Secure API authentication

Role-based access control

Audit logs & compliance reporting

This ensures trust and reliability for global clients.

The Competitive Advantage of Intelligent Algo Software

Traders using automated systems consistently outperform manual traders in speed and discipline. By adopting Best Algo Trading Software, firms gain:

Faster execution

Reduced operational costs

Improved risk control

Scalable trading operations

This competitive edge is essential in today’s markets.

Final Expansion: Scale Globally with Algo Software

From Algo Trading in UAE and Algo Trading in India to Algo Trading in US, Europe, and Asia, algorithmic trading continues to dominate financial markets.

If your objective is to build scalable, AI-powered Algo Trading Software Development solutions, deploy Forex Trading Algorithm Software, or operate a global Algo Trading Platform, we provide the technology and expertise to help you lead.